African tontines: a phenomenon as widespread in Africa as it is unknown in Europe

9 December 2006: Neighbourhood tontine in Niamakoro, Bamako, Mali

Jeanne Semin, L’argent, la famille, les amies: ethnographie contemporaine des tontines africaines en contexte migratoire.

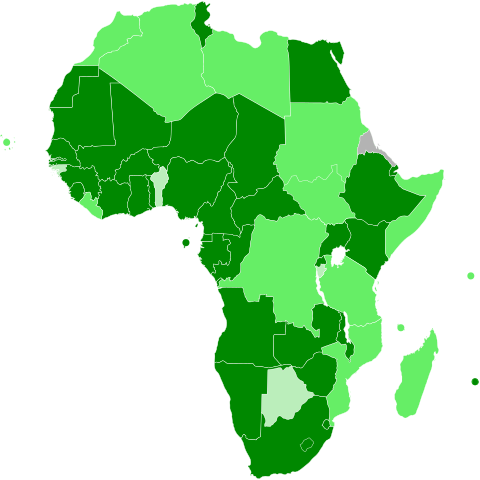

To fully understand the importance of tontines, it is necessary to start from one observation: in 2018, in Africa 85% of the population is excluded from the banking system and does not have access to financial services despite the 25 stock exchanges on the continent. For example, in Côte d’Ivoire, the banking rate is only 15%[1]. As a result, Africans have long since decided to turn to an informal credit system that makes it easy and quick to obtain financing: the tontine mechanism.

Historical origin, evolution and legal recognition

Historically, the tontine owes its name to the Neapolitan banker Lorenzo Tonti[2] who was asked by Mazarin in the 17th century to find a method of financing to replenish the State’s coffers. Tonti will then propose a process whereby each subscriber pays an amount into a fund and receives dividends from the invested capital. It was agreed at the time that the State would recover the capital invested.

Thus was born the mechanism of tontines which later became widespread to give birth to associations bringing together members of a clan, a family, neighbours or individuals who decide to pool goods or services for the benefit of everyone, and this in turn. This is the definition that can be given to the tontine mechanism today.

In terms of its legal recognition, this mechanism has not yet fully acquired it. Tontine does not yet have a clear status as it is not legally recognized by African national governments. However, laws on mutual or cooperative savings and credit institutions are being adopted before national parliaments in the West African Economic and Monetary Union area[3]. The legal recognition of tontines in Africa is therefore on the right track.

A protean mechanism

Tontine can take different forms. Initially, it was essentially a “working tontine”: members joined forces to help rebuild houses together or carry out work of public utility (for example, the construction of a school, a cemetery, a water tower, etc.). As money began to circulate, the forms of tontine diversified and took different alternatives. There is in particular the “mutual tontine” which consists in collecting monthly from each member an amount previously fixed and the total amount thus collected monthly without interest accrues to one of the members according to a pre-established order… The “commercial tontine” As for it, it has a specific feature: the funds are collected by a third party who has taken the initiative to create the group and who acts as a banker responsible for adjusting the savings collected and the loans disbursed as well as possible in return for a commission; the funds collected are subject to interest. Finally, in the case of the “financial tontine”, the deposits made by all participants are auctioned according to statutorily defined terms and conditions ;the highest bidder therefore pays interest to borrow the tontine money. This form of tontine is very common in Cameroon, so it is called “buying money”[4] to refer to participating in a tontine.

Tontines can also be distinguished according to the nature of the links between the individuals forming them. As a result, the closed tontine, which corresponds to the situation where individuals who gather together know each other in advance, differs from the open tontine where people do not know each other before deciding to form the tontine.

A vector of solidarity and entrepreneurship

African women are the main users of tontines. A survey conducted by anthropology professor Parker Shipton in 1987 revealed that 17% of the women interviewed belong to tontines compared to only 1% of men[5]. Although the situation has changed, the proportion remains the same. A majority of female tontine members are still found today, for several reasons.

First of all, at the economic level, tontine makes it possible to overcome a difficulty of access to the formal banking system. The procedures are sometimes too complicated for these women. Moreover, confidence in the traditional banking system is low compared to that which women have with members of the tontine, who are often part of their restricted social circle. Finally, tontine facilitates savings because of the moral obligation to contribute financially and periodically and therefore not to spend the money provided for this purpose[6].

In addition, the social aspect, which is the most important, allows women to come together to share their problems and help each other. Above all, it is a matter of spending a friendly time together and sharing projects, worries and suffering, and often these tontines constitute a real circle of female solidarity that replaces the social security system of public services.

This social aspect is expressed in particular in the obligation to make based on the morality associated with groups with strong ties such as family or friends. Thus, due to significant social pressure, refusing to give is a risk of social exclusion. The most important factor is therefore the trust in each member, which is the only guarantee of the tontine’s safety. From this trust comes the duty to be present at each meeting in order not to create mistrust within the group.

Persistent criticism

Although this credit mechanism provides significant benefits to African women, it is not exempt from some criticism.

African governments see this as an obstacle to development with the implementation of parallel financing. However, tontines allow many women to invest in new projects, develop or expand their commercial or economic activities. Therefore, it is possible to question the validity of this criticism.

Bankers, for their part, highlight the liquidity leak produced by tontine[7]. But given the difficulty of access to the traditional banking system, the use of tontine by the African population has become a widespread way to overcome this difficulty.

Finally, the lack of equality between members is surely the most virulent and realistic criticism of tontines. Indeed, the first beneficiary benefits from an immediate free loan while the last does not receive interest and inflation risks eroding the debt.

In conclusion, despite criticism, this tontine mechanism is now being used substantially on the African continent, even competing with the formal banking system. Although still in the stage of simple informal practices, the massive use of tontines heralds a future institutionalization of this mechanism by African governments.

Agathe Soitel

[1] http://www.seneweb.com/news/Afrique/plus-de-85-des-africains-exclus-du-syste_n_158203.html

[2] http://www.tontine8.com/actualite/l-histoire-de-la-tontine/

[3] Thèse : Matthieu GASSE-HELLIO, Les tontines dans les pays en développement, Université de Versailles Saint-Quentin-en-Yvelines

[4] Reportages TV5MONDE “tontines et microfinance”

[5] Thèse : Matthieu GASSE-HELLIO, Les tontines dans les pays en développement, Université de Versailles Saint-Quentin-en-Yvelines

[6] https://blogs.mediapart.fr/oliv92/blog/020815/les-tontines-en-afrique-de-louest

[7] https://www.agoravox.fr/actualites/economie/article/les-tontines-en-afrique-ancetres-34275

I found your weblog web site on google and examine a number of of your early posts. Proceed to maintain up the superb operate. I just extra up your RSS feed to my MSN Information Reader. In search of forward to studying extra from you afterward!